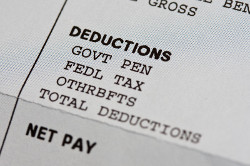

Does your employer fail to provide your pay stubs on a regular basis? Do you constantly complain about inaccurate pay stubs? Does it seem like relevant information is missing from your pay stub? Pursuant to California Labor Code 226 employers must provide each employee with an itemized written wage statement detailing specific information. In the event information is missing, the employee is entitled to penalties (discussed in further detail below). Information that must appear on these wage statements includes:

- Gross wages earned

- Total hours worked by each employee (not required for salaried and exempt employees). This includes rest break time and waiting time for piece rate employees;

- The number of piece-rate units earned any applicable piece rate if paid on a piece basis;

- All deductions;

- Net wages earned;

- Start date and end date for the pay period;

- The name of the employee and the last four digits of his or her Social Security number (or employee identification number);

- The employer’s name and address;

- For piece-rate workers, the total hours of compensable rest and recovery periods, the rate of compensation, and the gross wages paid for those periods during the pay period;

- All applicable hourly rates in effect during the pay period, and the hours worked under each hourly rate separately listed, i.e. (regular hourly rate, overtime rate, double overtime rate, etc.)

Penalties for Missing, Incomplete, or Inaccurate Paystubs

An employee that suffers injury as a result of an employer’s knowing and intentional failure to comply with the requirements discussed above may recover $50 for the initial pay period and $100 for each violation in a subsequent pay period not to exceed $4,000.00, plus costs and reasonable attorney fees. An employee who has suffered as a result of an employer’s failure to comply with paystub requirements is entitled to bring an action for injunctive relief ensuring that California law is followed by the employer, and is entitled to an award of costs and reasonably attorney fees.

Inspection Rights for Employee Paystubs

Workers who suspect that there may be some issues with their wage statements can request to inspect them. Pursuant to Labor Code Section 226, Current and former employees have the right to inspect or copy their wage statements on reasonable request. Employers must respond to an oral or written request within 21 days or be subject to a $750 penalty.